Environmental, social and governance factors

The Challenger IM team believes that incorporating material environmental, social and governance (ESG) factors in investment decisions can improve investment outcomes for clients by promoting more sustainable business practices and reducing the risk profile of investments.

The Challenger IM team has a systematic approach to incorporating ESG considerations into its investment process, and its specialty in private lending markets provides a greater opportunity for active engagement. The team manages investment portfolios taking into consideration ESG risks as part of a thorough and robust investment process. It regards these risks as being inherently linked to the sustainability of the businesses to which it lends, to their ability to refinance and ultimately the risk of default.

The Challenger IM team believes that its approach to ESG integration not only benefits its clients but also can have a positive impact on society and the environment.

ESG philosophy

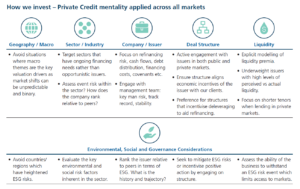

The Challenger IM team’s investment philosophy is heavily influenced by its heritage in private lending markets. For over a decade the team has approached credit markets as a lender as well as an investor. As an investor the team applies a relative value approach, integrating ESG risk factors into its pricing and valuation considerations, and as a lender prioritises direct engagement to mitigate ESG risk factors through incentivising more sustainable business practices.

The Challenger IM team’s approach is guided by these key principles:

- To us responsible investing is about being responsible to clients to deliver long term predictable streams of income. Over the long term the Challenger IM team can only do this by incentivising sustainable business practices from the businesses it lends to. It does this by raising the cost of capital for businesses who do not engage in sustainable business practices and lowering the cost of capital for businesses who do.

- The Challenger IM Fixed Income team assesses ESG risk against exogenous factors. There are only two ways that the team can exit a position: either the cashflows of a business pay down the Challenger IM team’s debt or other investors refinance the team’s position. If the cash flows generated by the business are insufficient to pay the team back, then the Challenger IM Fixed Income team need to be comfortable that other investors will be prepared to lend to the borrower at the time of refinancing which could be 5 or more years into the future. The team considers responsible investing to be gaining rapid attention from a broader investment group which will have an impact on long term investment outcomes and we believe this is something all investors should be mindful of, regardless of their investment philosophy.

- Effective engagement drives positive performance by mitigating downside risk. The Challenger IM team believes effective engagement incentivises more sustainable business practices. For many years the team has achieved this through a focus on structure and documentation as a means to manage risk, a prioritisation of direct due diligence with borrowers to gain transparency into business practices and by promoting better market practices on behalf of all market participants. The team’s long history in private lending markets informs its approach to effective engagement across both public and private strategies.

- ESG risks are most pronounced when poor environmental or social practices are combined with poor governance. Environmental and social risks are inherent in many businesses. Most have adapted to evolving standards around their business practices. However, the Challenger IM team believes businesses with poor governance are most at risk of prioritising short term results over long term sustainability, greatly increasing their risk of default.

These principles inform the Challenger IM team’s approach across public and private lending strategies. Assessing the sustainability of the businesses, pricing for the risks identified and engaging with borrowers to mitigate these risks has always been embedded in the team’s investment process.

ESG integration

For further information on the team’s ESG integration process please refer to the Challenger FI Responsible Investment Statement.

The following Funds have been classified as Article 6 products for the purposes of Sustainable Finance Disclosure Regulation (SFDR) in the European Union.

Challenger Investment Management Global Asset Backed Fund

The investments underlying this financial product do not currently take into account the EU criteria for environmentally sustainable economic activities.

The Fund does not currently promote environmental and/or social characteristics in a way that meets the specific criteria contained in Article 8 of SFDR and does not have sustainable investment as its objective in a way that meets the specific criteria contained in Article 9 of SFDR.

Notwithstanding this, the Investment Manager still considers that the Fund is managed responsibly. The Investment Manager evaluates and integrates Sustainability Risks and other relevant ESG factors throughout the investment process. The Investment Manager regards these risks as being inherently linked to the sustainability of the businesses to which it lends, to their ability to refinance and ultimately the risk of default.

Sustainability Risk Statement

We manage investment portfolios taking into consideration sustainability risks as part of a thorough and robust investment process.

We consider the materiality of sustainability risks in the context of:

- their impact on the sustainability of the businesses to which we lend,

- to their ability to refinance; and

- the risk of default

Sustainability risk factors that we consider include:

- Environmental: Fossil fuel dependence, mining carbon emissions, stranded assets, raw material sourcing, toxic emissions and waste

- Social: health and safety, labour management, privacy and data security, product safety and quality, responsible lending, supply chain labour standards, modern slavery

- Governance: Ownership, Board, risk management and internal controls, accounting standards, business ethics, anti-competitive practices, lack of disclosure

Based on our assessment of material sustainability risks we assign a High, Medium or Low risk rating for each category of environmental, social and governance. We will exclude any company with a High risk rating in any category. Additional scrutiny is applied to entities which have a Medium social or environmental risk layered with a Medium governance risk.

Due diligence process for asset-backed securities

Given the broad scope of fixed income instruments, the analysis of sustainability risks is tailored where needed for different types of issuers and transactions.

Recognising that the nature of fixed income is that the potential downside outweighs the potential upside of an investment, the focus of ESG analysis is largely to identify and protect against significant event risk that can impact issuer / originator creditworthiness and that of asset cover pools.

For asset-backed securities the investment managers process assessed criteria such as:

Assess the lending strategy of the originator

- What is the lending product?

- Does it have deleterious effects on society or the environment (e.g. payday lending)?

- How is the product originated?

- What are the credit policies of the originator (do they consider ESG risk in their decisions)

- Are there risks of misselling to borrower?

- What levels of disclosure are there around the product?

- Is the lending regulated or unregulated?

Assess the governance risks surrounding the structure.

- Is there proper segregation of cash?

- Is there an independent trustee?

- What is the organisational structure of the originator (e.g. are credit underwriters paid on volumes or performance)?

- Are collections outsourced?

We assess these Sustainability Risks based on both internal and externally sourced research and analysis. we assess local media outlets for timely alerts on relevant issues and entities to further inform our process.

2. No Consideration of Principal Adverse Impact Statement or Consideration of Principal Adverse Impact Statement:

Notwithstanding that the Investment Manager integrates the consideration of Sustainability Risks into the investment decision-making process, the Investment Manager does not consider the principal adverse impacts of its investment decisions on Sustainability Factors in respect of the Fund. The Investment Manager has opted against doing so, primarily because such information that would be necessary to enable the Investment Manager to make this assessment is not yet available for all the entities in which the Fund may invest.

The Fund does not expect to make any Sustainable Investments as defined by SFDR.

3. Remuneration Policy Summary:

The Investment Manager has put in place a Remuneration Policy which governs the fixed and variable remuneration structure of its employees. The Investment Manager is committed to implementing a remuneration framework where adherence to the principles set out herein is part of the performance management framework and can directly impact the overall remuneration of employees.