Funding the BNPL revolution

August 2021

The following article was published on Livewire Markets on 24 August 2021.

For the last couple of years, we haven’t been able to open the Australian Financial Review or pull up the Livewire site without seeing another article about Afterpay or the broader Buy Now Pay Later revolution. Two of our favourite AFR journalists were so fascinated with how divisive the stock became among the equity community that they decided to write a book about the company.

But what is fascinating to us is how the analysis by equity analysts, market pundits and journalists has almost exclusively focused on the equity side of the equation. It was either the upside potential coming from the move to online, greater market penetration and the broader use cases beyond shoes and fashion or the downside risks of regulatory crackdowns, credit quality deterioration and increased competition driving margin compression.

As far as we have read, there has been little written from the perspective of those who fund this so-called revolution. After all, someone is providing the cash to allow the “Buying Now”. Seeing as funding stuff exactly what we do here at CIPAM, we thought we’d have a go at providing some insight as to how to think about the funding side of the equation. In this piece we want to answer 3 questions:

- How much funding is needed?

- How is this revolution to be funded??

- Based on the answers to the above two questions, can this revolution be funded???

The first question to be answered here is how much funding is required. In March, the Reserve Bank of Australia estimated that in 2019/20 BNPL platforms processed over $9 billion in transactions, a year on year increase of 50% on 2018/19. WorldPay has the number of users of BNPL products doubling from 2 million to 4 million by 2023, presumably implying close to $20 billion in transactions being processed.

But how much is being funded right now?

The answer is actually pretty hard to come by. Most BNPL providers are focused on metrics such as transaction volume, active merchants or active users. But from a funding perspective, what matters is receivables outstanding because that is what requires the funding.

Based on our estimate, the current outstanding receivables across domestic BNPL platforms is $3-4 billion and is growing at an annual pace of 50% implying a potential market size $6-8 billion by 2023.

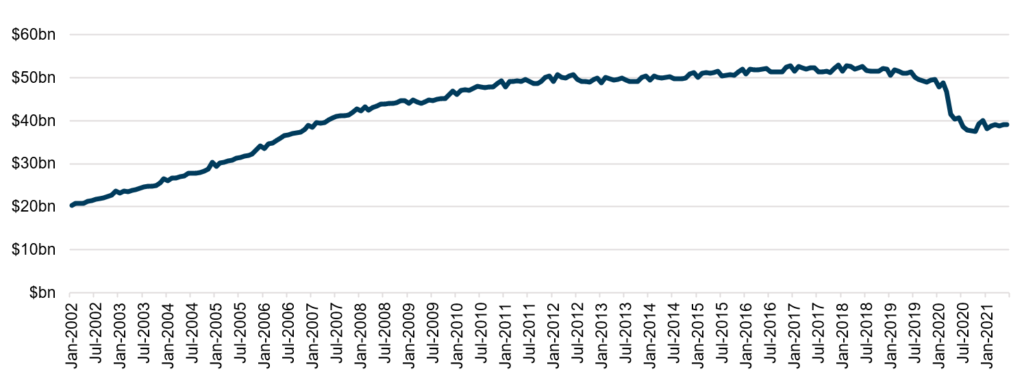

Compared to the more mature market of credit cards, this market size does not seem unreasonable with outstanding balances currently around $40 billion, down from around $50 billion pre-COVID levels (a move which we think is much more about COVID than about the cannibalisation by BNPL products).

Total Credit Card Balances Outstanding

The next question is how is the $6-8 billion to be funded?

The most logical answer and the one that has been used to date is via securitisation markets, both public and private. This has been predominantly in private markets to date but an increase in public securitised issuance is inevitable as there is a reasonable capital impost for banks financing these assets in securitisation warehouses.

Notwithstanding quite extraordinary equity valuations, public securitisation seems to be clearly the cheapest and most scalable source of financing at an estimated cost of approximately 2% over the bank bill swap rate.

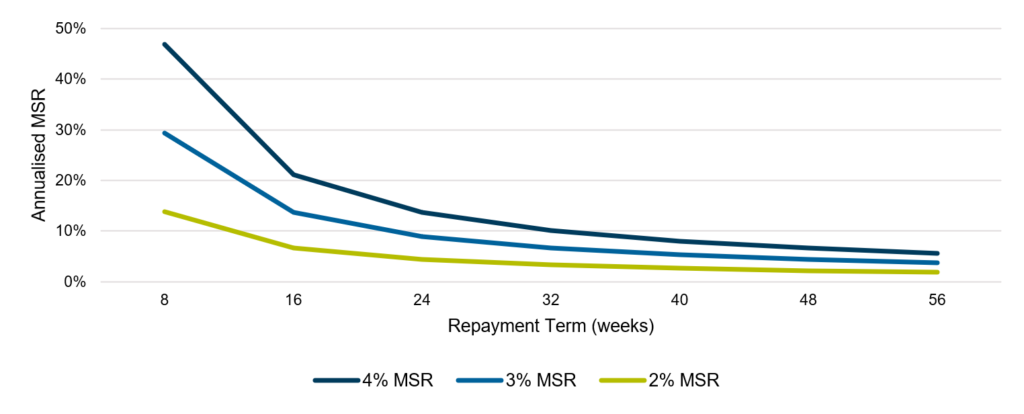

In saying this, one factor in the securitisation equation that is crucial to understand is that securitisations are bankruptcy remote. They cannot rely on the originator to provide top-ups to income; this must come from the BNPL receivables sold into the trust. Unlike typical securitisation collateral which pays regular interest payments, the primary source of income on BNPL receivables is the merchant service revenue (MSR). While the average MSR seems quite stable at around 4% with around 1% in processing costs, the length of the repayment terms can vary widely with the larger contracts tending to be long term. For longer repayment terms the impact of lower MSR’s will be problematic. Unsecured consumer lending tends to have gross (i.e. pre-loss) yields of around 15%. Much lower than this and yield stress becomes an issue. In our view, BNPL products that have repayment terms longer than 24 weeks and MSRs of 2% or lower will be difficult to fund via securitisation vehicles.

Annualised MSRs by Repayment Term

While in our view, securitisation is the obvious financier of the revolution there are real capacity questions that need to be answered, bringing us to the final question which is “can this revolution be funded?”

Arriving at an exact figure for total BNPL issuance is difficult as many issuers commingle interest-bearing products with the zero interest BNPL later product but we estimate that there is currently around $2 billion in securitised debt outstanding which contains some BNPL receivables in the underlying collateral pool. This is a drop in the ocean compared to the c. $97 billion in domestic securitised issuance over the last couple of years albeit is around 15% of non-RMBS issuance.

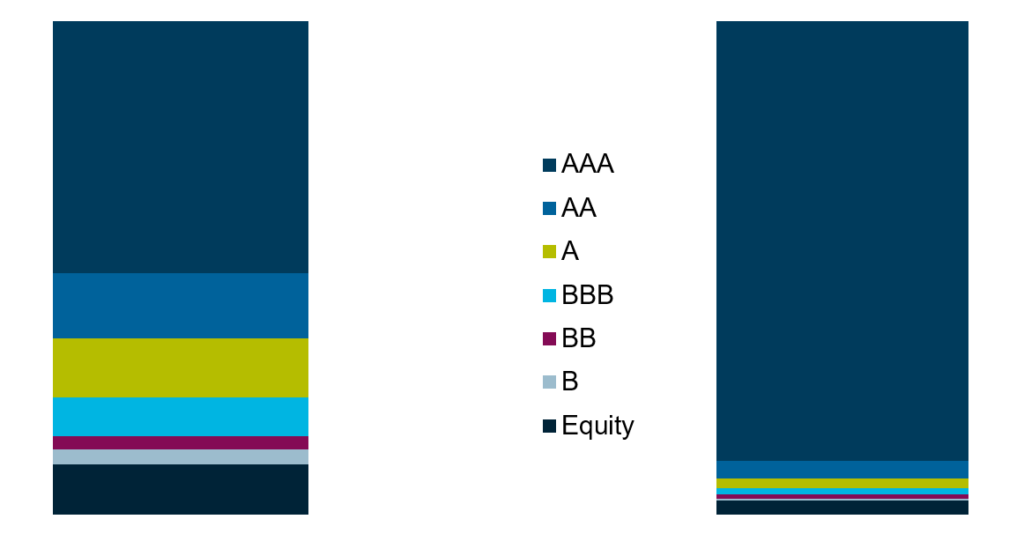

Split of Australian BNPL ABS Issuance by Rating (LHS) and Total ABS/RMBS by Rating (RHS)

And as we show above, what is more meaningful is the proportion of non-AAA rated issuance coming from BNPL deals. Effectively, half of a BNPL transaction is non-AAA versus 10% of the remaining market. The greater share of the mezzanine is really just a function of higher losses in BNPL versus other forms of securitised lending (estimated of 4-6% annual losses as a percentage of receivables versus <1% for RMBS pools) and lack of data showing performance through a credit cycle. Investors need to remember that from the perspective of financiers and rating agencies alike, BNPL is still a relatively untested product.

As such, BNPL mezzanine issuance is around 10% of total mezzanine issuance in Australian securitised and 25% of non-RMBS mezzanine issuance. If current growth rates are maintained this share is likely to quickly increase to 25-30% of total mezzanine issuance and close to 50% of non-RMBS mezzanine issuance. This is significant for an unsecured product focussed on a relatively narrow consumer segment.

In our view, the jury is still out on whether this revolution can be funded. The BNPL product is still relatively untested and is being funded in a market that itself has faced its own challenges in recent years.

The reality is that as the BNPL product grows, the success of these platforms will become increasingly dependent on favourable debt capital market conditions.

Those followers of the equity story would be well served increasing their focus on this relatively obscure part of the market.

As always, we welcome feedback,

Pete Robinson

Head of Investment Strategy – Fixed Income

Unless otherwise specified, any information contained in this material is current as at date of publication and is provided by Challenger Investment Partners Limited (CIP Asset Management, CIPAM) (ABN 29 092 382 842, AFSL 234678), the investment manager of the CIPAM Credit Income Fund ARSN 620 882 055 (Fund). Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante) is the responsible entity and issuer of interests in the Fund. Fidante and CIPAM are members of the Challenger Limited group of companies (Challenger Group). Information is intended to be general only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com.au should be considered before making a decision about whether to buy or hold units in the Fund. Past performance is not a reliable indicator of future performance. Fidante and CIPAM are not authorised deposit-taking institutions (ADI) for the purpose of the Banking Act 1959 (Cth), and their obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante and CIPAM. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.