A condensed version of in this article featured in Fixed Income News Australia (FINA), 2 August 2021

We provide our quarterly around-the-grounds perspective on public and private credit markets, highlighting the risks and opportunities emerging following the most recent COVID outbreak across the east coast of Australia.

Non-Financial Credit:

Summary views: public investment grade markets at post-GFC tights with extremely low spread volatility, high yield less so. Private markets look considerably better value with illiquidity premiums near the wides.

“Carnival Said to Prep Bond Sale for Next Week to Buy Back Debt”

This recent headline sums the state of play in global risk markets right now. Carnival, an operator of cruise ships which is currently rated B1(neg), B(neg) by Moody’s and S&P, respectively is issuing bonds to buy back debt. The cruise ship industry has yet to recommence at any scale and Carnival is still burning through liquidity (US$500 million a month in 1H21) and yet they look likely to be able to issue unsecured debt at around a 4.5% yield in order to retire secured debt issued at the height of the pandemic at an 11.25% yield.

Despite the global pandemic being far from over, stories like this are becoming increasingly prevalent and reflect the easy financial conditions right now.

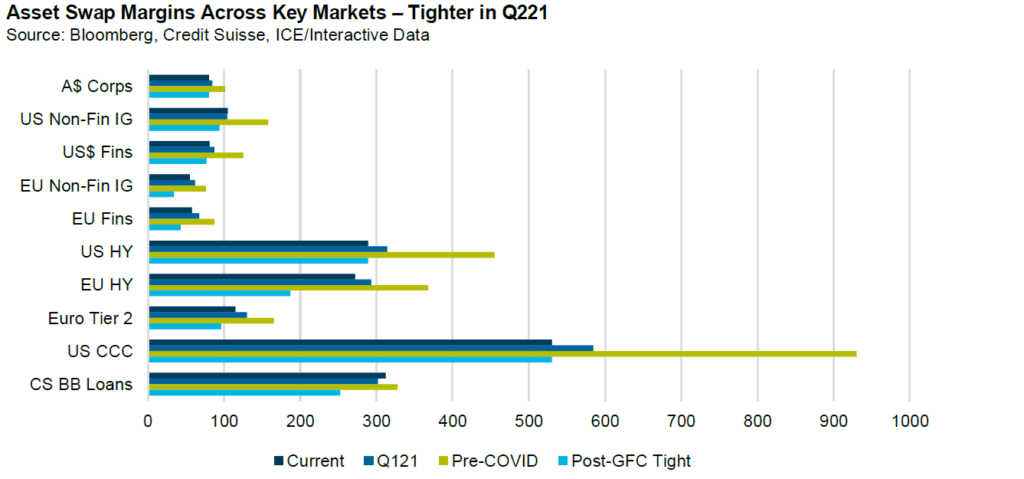

Over the quarter spreads tightened modestly with all indices below except for US leveraged loans having already more than retraced pre-COVID levels.

In addition to spreads being tighter, they were also less volatile. On a trailing 60 day basis, spread ranges were around close to post-GFC lows. And unlike spread levels which are still wide of pre-GFC tights, these ranges are actually in line with pre-GFC levels. During Q221, the US Non-Financial IG Index traded in only a 6 basis point range with the high yield index trading in a 26 basis range.

Domestically similar themes have played out. Spread ranges were tight despite strong corporate issuance. At $4.8 billion for the quarter and $9.8 billion for H1, issuance levels are well above historical averages but with still no meaningful financial issuance to speak of, spread levels have continued to grind tighter. REITs have been the strongest net issuers this year and there is certainly some risk of indigestion from that sector and certainly risks to wider spreads if financial issuance surprises to the upside.

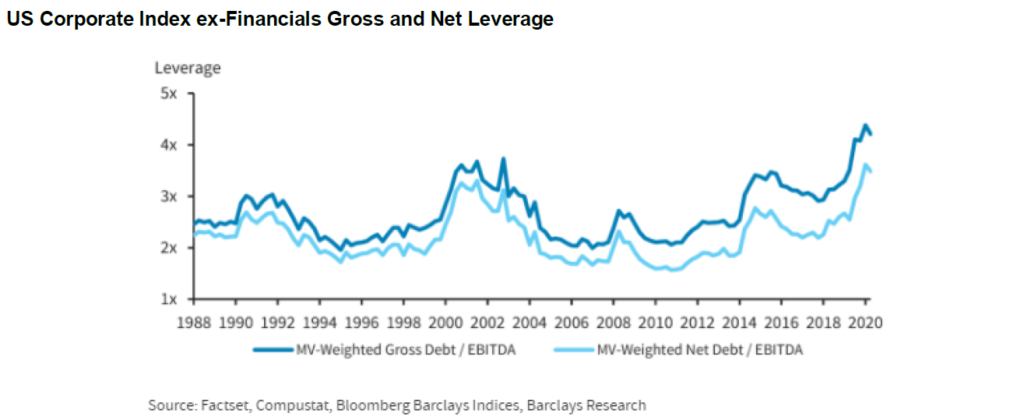

Fundamentally, corporate balance sheets seemed to have improved, or at least stabilised. Defaults are down, high yield leverage is back at pre-COVID levels (albeit in part due to defaulted names leaving the sample and fallen angels being included) and Federal Reserve Senior Loan Officers Survey data is showing a net 15.1% of banks loosening lending standards. Investment grade leverage is still elevated as we show below, but is showing signs of improvement.

The stabilisation (moderation?) in credit spreads globally has created ideal conditions for private lending markets to recommence and we have seen this occur with force. Elevated levels of M&A activity continued into the June 2021 quarter with the support of medium-term deal-conducive conditions like low interest rates and elevated sponsor dry powder. Adding to M&A tailwinds was the pause taken by the IPO market which has traditionally been a reliable exit avenue for PE Sponsors. The poor after-market performance of recent IPOs, some of which were private-equity backed like Adore Beauty (Quadrant) and Pepper Money (KKR) has given equity investors pause for thought and this led to a number of aborted IPOs in the June 2021 quarter. This should lead to more private sale processes in the coming months further increasing M&A activity levels for the rest of the year.

The quarter saw deals launched for financing in the large-ticket M&A space:

- $2.1bn Term Loan B (TLB) financing for MIRA (Macquarie Infrastructure & Real Assets) & Aware Super’s $4.6bn acquisition of Vocus Group

- $1bn TLB financing for MIRA’s $2.6bn acquisition of Bingo Industries

Other large Aussie TLB issuers also took advantage of attractive credit market conditions to upsize 1st lien tranches and pay down more expensive 2nd lien tranches in order to lower interest costs. This was only available to credits which traded well and de-leveraged meaningfully through the last 12-18 months.

- Arnott’s upsized its 1st Lien Term Loan by A$315m to repay its 2nd Lien Term Loan Facility

- APM raised new $730m of 1st Lien Term Loans in order to repay 2nd Lien Term Loans entirely and refinance existing 1st Lien Term Loans.

There were also signs of a return to activity in the mid-market space with KKR taking a majority stake in online education services provider Education Perfect for $350m, the sale of Healthecare’s surgical acute hospitals business to Pacific Equity Partners for $400m and the sale of early leaning business Affinity Education Group to Quadrant PE for $650m. Financing processes for these transactions will commence in Q321.

Financial Credit:

Summary views: financials remain expensive. Lockdowns create more technical and fundamental uncertainty across the capital structure. Offshore markets suggest that when issuance comes back, it will be significant.

The ongoing lockdowns in Australia plus the ongoing global challenges in managing the more reproductive delta variant strain of the COVID-19 pandemic make the questions around bank funding needs a difficult one. Last year during the initial lockdowns, banks received strong deposit inflows and cheap funding from the Term Funding Facility (TFF). Loans were repaid with the support of government programs such as JobKeeper, JobSeeker and the superannuation access scheme. With the TFF over and federal programs both the banks themselves and their underlying customers are already exposed to lower levels of support. Our base case is that the longer the lockdowns last, the more accommodative government support will be, thus mitigating the tail risks to bank supply. This being said it will take until early August to start to see this flow through into the data.

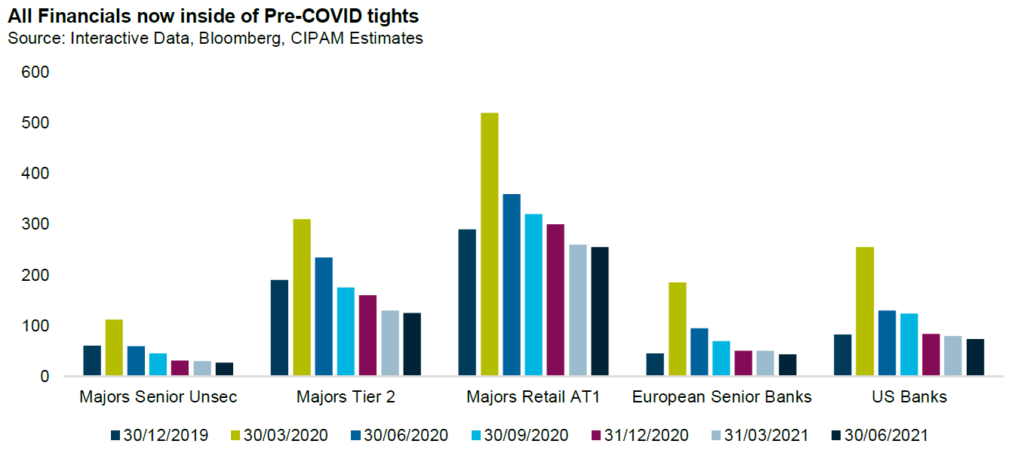

Arguably this alone is a good reason for caution. With spreads where they are starting the quarter, we’d argue that investors should have already been cautious. As the chart below shows, spreads across both domestic and offshore financials are now inside pre-COVID levels. Domestically, Tier 2 debt is now 65 basis points inside pre-COVID levels while riskier retail Additional Tier 1 markets are “only” 35 basis points tighter.

Turning offshore, spreads have also been tightening but are relatively wider than domestic markets. During Q2 reporting, US banks called out similar themes to what we have been discussing domestically with strong earnings fuelled by releases of COVID-19 provisions. Interestingly, deposit growth which in a similar vein to the domestic banks, had been very strong, has flatlined recently as the reopening of the US economy has gathered pace. Loan growth has been limited to consumer loans with corporate and institutional loans down by 3.5% in the first half of the year. In contrast, the Australian banks had grown their loan books by 2% in the first half of 2021.

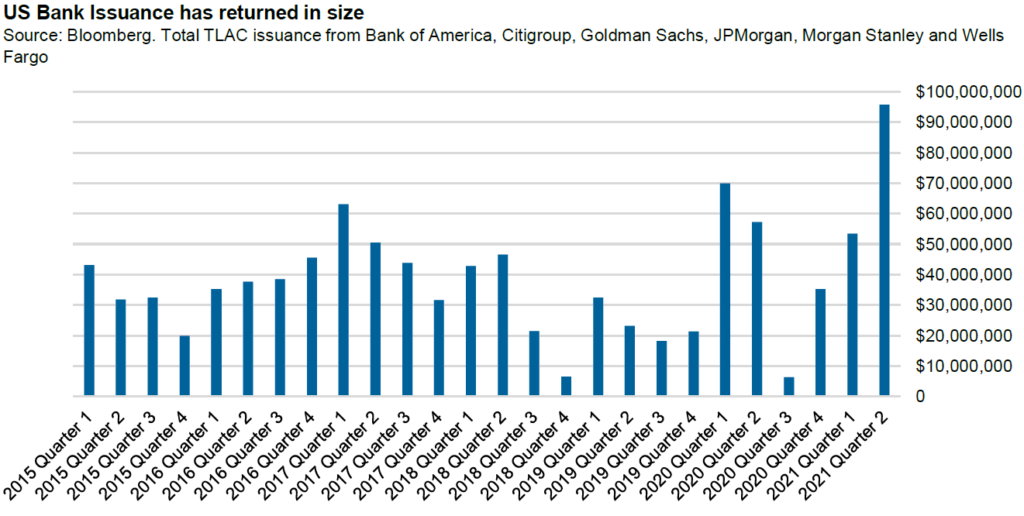

On the issuance front, the six major US banks issued US$95 billion in total loss absorbing capacity debt in Q2, a record by a considerable margin. This may be a harbinger of what is to come domestically when (if?) Australia reopens the wider economy. Domestically, major bank senior unsecured issuance was A$5.5 billion for the quarter. While this was more than double the last 4 quarters of issuance combined, it remains less than half the quarterly issuance over 2017-19. Tier 2 issuance was more elevated related to historical levels, with the majors issuing more than A$4 billion for the fourth consecutive quarter.

ABS & Whole Loans:

Summary views: negative on public domestic investment grade mezzanine tranches, neutral on sub-investment grade public mezzanine given lower credit enhancement levels but positive on private market opportunity set

“But as long as the music is playing, you’ve got to get up and dance.” So said Chuck Prince, former CEO of Citigroup in 2007.

Well Chuck, down under in securitisation markets, the music is still playing and it doesn’t look like many folks are leaving the dance floor. Last quarter we highlighted that Australian/New Zealand securitisation markets had started slowing but kicked into gear in March with the strongest March since 2007. This continued into the second quarter with close to A$11 billion in issuance taking total issuance to just under A$18 billion. As was the case in the first quarter, issuance was dominated by non-banks as the banking sector availed itself of cheap funding via the Term Funding Facility.

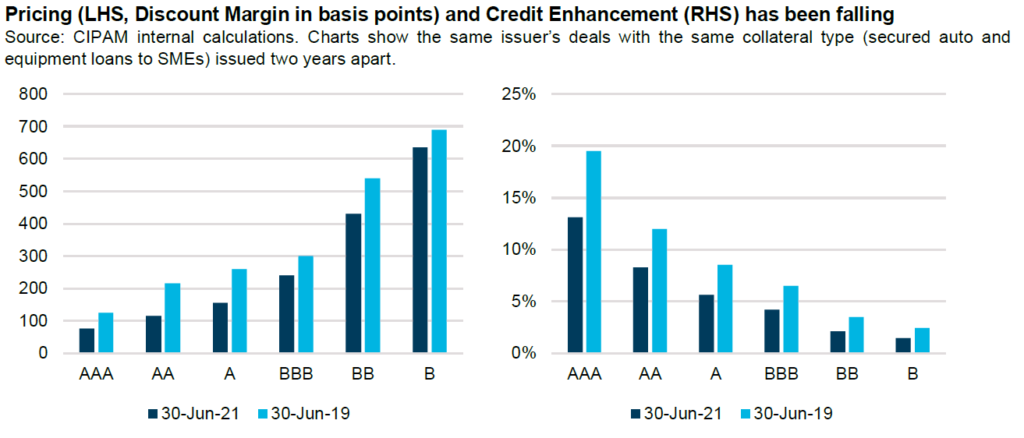

As is often the case, the strong issuance levels did not weigh on spreads with senior spreads remaining broadly rangebound over the quarter and mezzanine spreads continuing to rally. The spread tightening has been most pronounced in the senior investment grade tranches as shown by the sample ABS transaction below. The biggest lag in pricing moves has been in the most subordinated tranches with the margins on B-rated mezzanine tranches around 10% (c. 70 basis points) tighter.

While the move in pricing has been discussed widely in the market, what has not been covered is the steady erosion in credit enhancement on transactions. Where we stand today is that returns on securitisation transactions today are lower than at any point post 2007 with less credit enhancement provided.

While we do have a negative view on spreads and are limiting our domestic exposures to shorter dated transactions with strong call protection, the music may still be playing for those investors with a more limited universe. The reality is that spreads across the most public credit markets are tight and domestic ABS may appear cheap to bank tier 2 issuance, corporate hybrids, offshore ABS and other higher spread products.

Indeed, the theme of elevated issuance applied equally in European markets as well. According to Bank of America, placed issuance totalled EUR54 billion in 1H21, up 18% and 28% on 2020 and 2019, respectively. The UK was responsible for around half the non-CLO supply, itself driven by non-bank non-prime RMBS, a similar trend to what we observe in Australia.

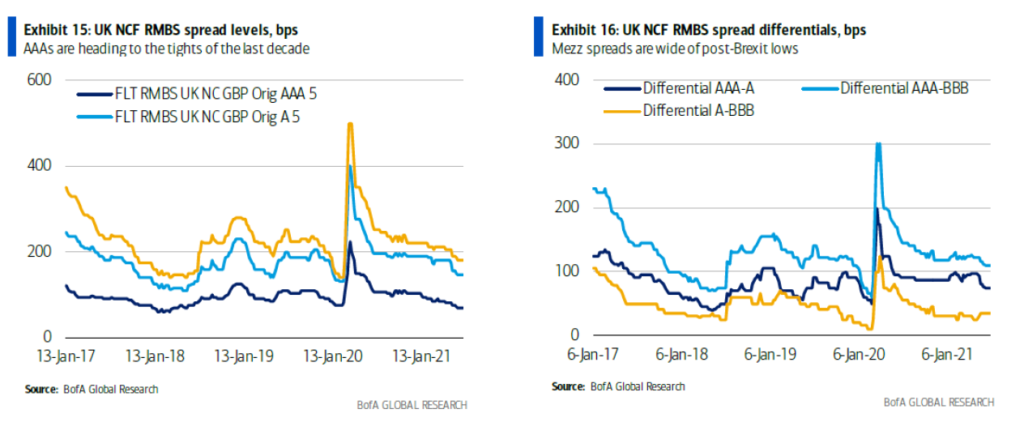

In relative value terms, UK RMBS entered tighter than its Australian cousin but as shown below has not rallied inside pre-COVID tights, at least not in mezzanine tranches. This leaves the basis between Australia and UK mezz at around 30-40 basis points, considerably tighter than where it was pre-COVID. It remains to be seen whether the 30- 40 basis points is worth the effort and hedging costs for a European domiciled investor, especially when the relative illiquidity of the Australian mezzanine market is considered [1]. As the charts below also show both Australian and UK credit curves are very flat for investment grade ratings, with little incremental return on offer for incremental credit risk.

The relative tightness of domestic public securitisation contrasts greatly with what we are observing in private markets. The quarter was punctuated by the sale of Westpac’s auto finance business to Cerberus/Angle Finance. The AFR reported that the funding package was as much as $5 billion dollars and if the business is as successful in private equity hands as it was with Westpac, then that funding requirement could double. Below the surface there was a significant level of activity in more middle market style transactions with the CIPAM platform alone reviewing $2 billion in opportunities across over 40 deals.

Real Estate Loans:

Summary views: private real estate markets look attractive for stabilised assets but recent lockdowns create uncertainty. Public markets have lagged due to consistent issuance and weaker fundamentals.

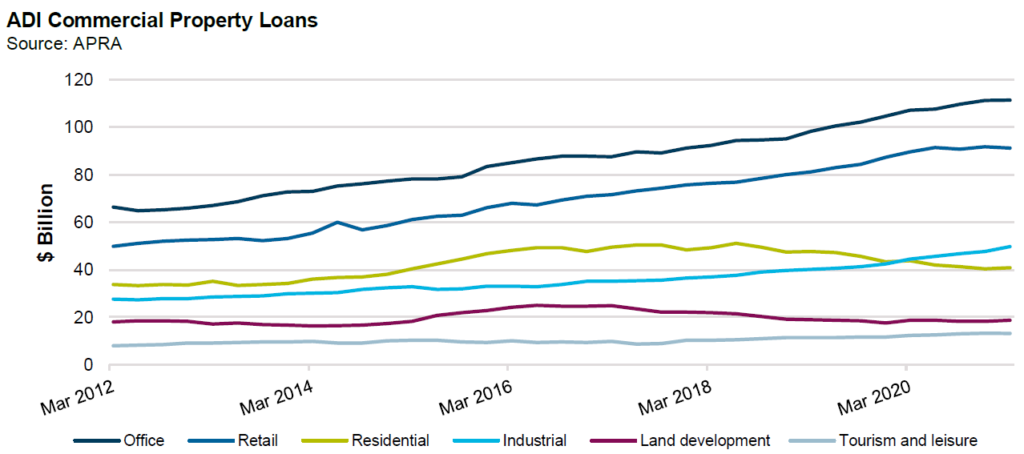

APRA data through the March 2021 quarter showed commercial property exposure limits for ADI’s continued to increase ending at $362.4b ($305.4b drawn), a 3% annual growth rate. The major banks market share is 75% (77% previous corresponding period).

The lending growth has been concentrated in the core sectors of Office, Retail and Industrial which each grew at a rate of 2% to 12%. This was partially offset by a 7% decline in lending to Residential (now down 15% from mid-2016 peak). This was driven by the recent slowdown in new developments due to a lack of pre-sales. As noted by the RBA it seems at least some of the pull back in ADI lending to developments has been offset by non-bank lenders.

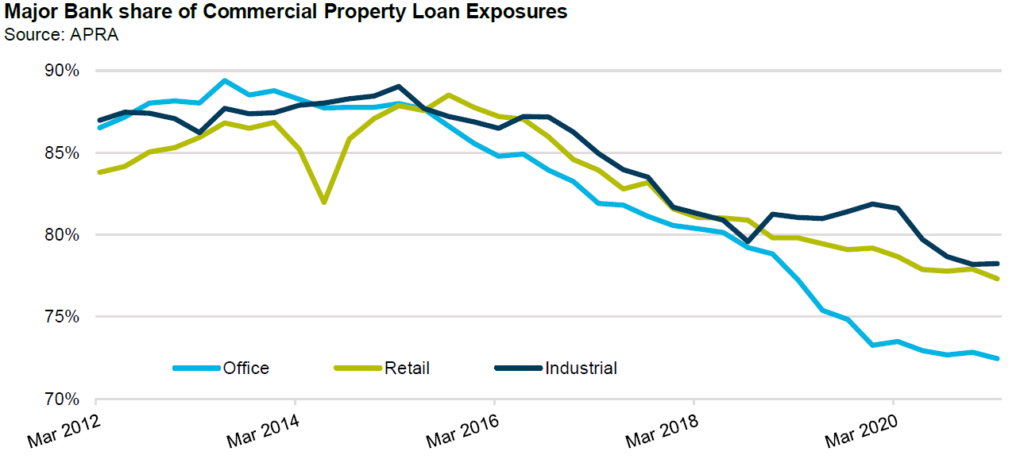

The major banks have maintained their market share of total ADI exposure to Office, Retail and Industrial.

The performance of ADI commercial real estate lending portfolios remains strong at March 2021 with impairments at 0.2% of asset values, the lowest levels since March 2005, albeit this is expected to increase in APRA’s upcoming quarterly releases due to the impacts of COVID-19 and the ending of relaxed treatment of property loans from a regulatory standpoint.

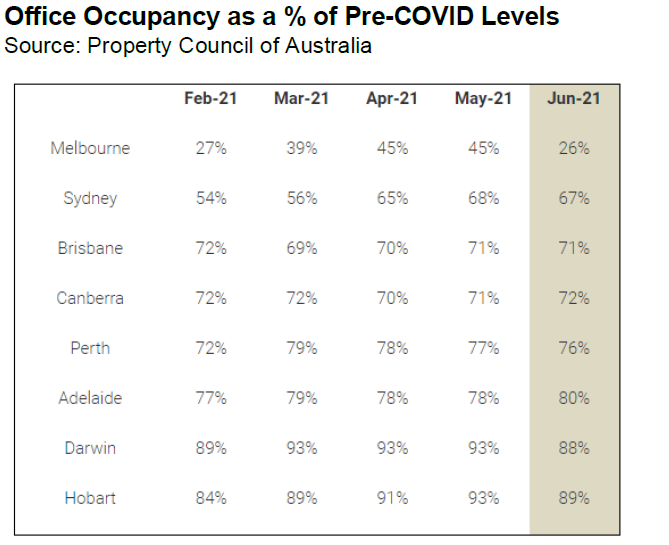

From a fundamental standpoint, occupancy levels were still struggling to return to pre-COVID levels, even before the lockdowns with Sydney, Brisbane, Canberra and Perth all ranging from 67% to 76% (Melbourne was 26% during the June lockdowns). Even peak occupancy nationally is 89% in Hobart suggesting that there will be some permanence to the work from home revolution. Prior to COVID lockdowns net absorption had turned positive for the first time since 2019 but recent lockdowns will significantly alter this trend as evidenced by the change in Melbourne occupancy from May 2021 to June 2021.

In public markets, the consistent issuance noted in the non-financial corporate sector has led to REIT spreads trading rangebound and lagging the wider market rally. With lockdowns spreading across the country retail REIT names will likely continue to lag markets.

In private markets pipeline has been strong just outside of bank lending markets. Over the quarter the team reviewed close to 20 opportunities only proceeding with a couple at margins in the 500s. We should note that with the construction industry included in the current lockdowns, none of the CIPAM portfolios are exposed to construction risk. According to the Australian Financial Review banks are already relaxing terms on so-called progress payments in order to ensure that projects get access to adequate liquidity to be able to re-start projects when required. Development and construction finance has always been the pointiest end of the commercial real estate lending risk spectrum and it remains the case today.

As always, we welcome feedback,

Pete Robinson

Head of Investment Strategy – Fixed Income

1 While liquidity in Australian securitised products has arguably improved in recent months, it is still relatively illiquid compared to European ABS or Australian corporate or financial bonds and has not been tested since March of 2020 where it proved to be less liquid than many had expected.

Unless otherwise specified, any information contained in this material is current as at date of publication and is provided by Challenger Investment Partners Limited (CIP Asset Management, CIPAM) (ABN 29 092 382 842, AFSL 234678), the investment manager of the CIPAM Credit Income Fund ARSN 620 882 055 (Fund). Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante) is the responsible entity and issuer of interests in the Fund. Fidante and CIPAM are members of the Challenger Limited group of companies (Challenger Group). Information is intended to be general only and not financial product advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider whether the information is suitable to your circumstances. The Fund’s Target Market Determination and Product Disclosure Statement (PDS) available at www.fidante.com.au should be considered before making a decision about whether to buy or hold units in the Fund. Past performance is not a reliable indicator of future performance. Fidante and CIPAM are not authorised deposit-taking institutions (ADI) for the purpose of the Banking Act 1959 (Cth), and their obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante and CIPAM. Investments in the Fund are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.